People are working hard to earn money for their loved ones or themselves, and that is why anyone would be excited when the salary day is near. Accompanying the excitement you feel is also a bit of disappointment because you will need to pay the taxes. The incomes of individuals are not the only taxable incomes, but the income of some companies can also have taxes. The government requires these taxes because they use the taxes on their projects. These projects go to road projects, housing projects, educational projects, military, agriculture, or any projects the government deems that people need.

Some people are not happy about paying taxes because they have their expenses to think of, but they cannot do anything about it. Taxes are essential for a country to function, that is why citizens must pay their dues to keep it going. If you are interested in lowering your taxes, here are some ways to reduce them.

Table of Contents

Proper Book Keeping

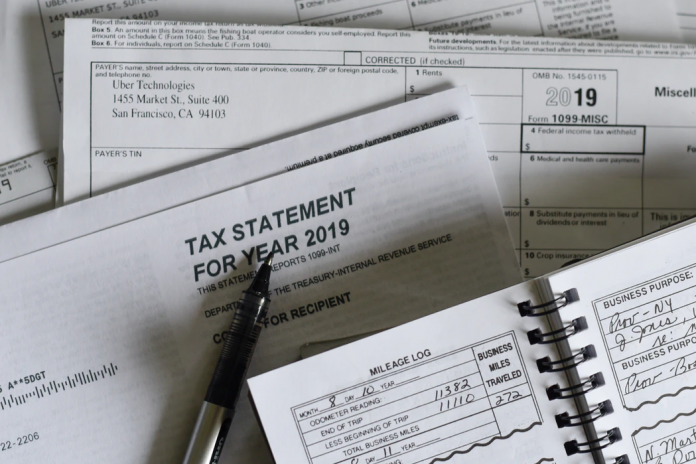

Another way of reducing your tax is by handling your book accounts properly. You need to make sure that all money coming in and going out is recorded and accounted for. You must write down all expenses and where you used them in full details for tax purposes. This also includes food delivery expenses with popular services like Postmates. If you purchase food on their app, you are eligible to deduct Postmates taxes. A detailed list of your expenses is useful when the time comes for tax deductions. This way, you will have a complete list and you will be able to deduct all the expenses you made and lower your taxable income.

Hire a skilled bookkeeper or accountant, because they have enough knowledge in the field and they know their way around possible deductions. They can even advise you on strategies on how you can make your decisions for deductions. Your bookkeeper will not only help you with your taxes, but he can also give peace of mind that finances are well taken care of so you can focus on running your business.

Tax Deductions

One way to reduce your taxable income is through tax deductions. These deductions are amounts subtracted to your taxable income, which will affect it, and possibly make it lower. There are a few examples of tax deductions that you can do. For example, there are advertising, promotions, losses, office supplies, amortizations, or fringe benefits costs you can record and list to deduct at the end of the year. If you own a company and you are planning to reduce your company’s taxable income, fringe benefits are the common deductions you can have.

Fringe benefits are benefits that you grant your employees in cash or in-kind in addition to their salary. Examples of these are housing, vehicles, vacation expenses, or insurance that you provide for them. You can also deduct the expenses you made on your office supplies like papers, coupon bonds, pens, and other stationeries.

Make Donations

Making donations is also effective to reduce your taxable income. You can give donations to churches or charities. The donations you can make do not need to be money. You can also donate other things that your donee needs. For example, if your donee is a church and it needs furniture, you can give chairs, tables, or cabinets as donations. Books and clothes are also possible donations, whether they are already used or still brand new. Items that your donee can sell for money are also accepted. So, if you have items in your office or house that you do not need anymore, it is better to give them out to those who need them most.

Keeping all of the receipts of the non-cash items you have given is necessary for future auditing, so you need to make sure that your receipts do not get lost. You need to keep detailed information because the law requires it. Donating is a great thing to do because you can accomplish two goals at a time. You will have the benefit of having your taxable income reduced and you will have the chance to help the other people in need.

IMAGE SOURCE: https://unsplash.com/photos/SBxdMoOY9zM

Taxes are reasonable because the government uses it for the benefit of the people. However, even when a lot of people understand, some are still complaining about it. The increasing rate of taxes is what most people complain about. Some claim that they are willing to pay taxes, but the rate is becoming unreasonable, and it seems like the government is robbing them of their money that they are supposed to use for their needs. Others are willing and able, and they pay their dues in time.